From 1 January 2026, company car tax in Ireland was recalibrated once again and for some drivers, the difference is immediately noticeable.

Fully electric vehicles now benefit from a dedicated lower tax band, while drivers of higher-emission cars, particularly those with lower business mileage, face significantly higher Benefit-in-Kind (BIK) charges.

While Budget 2026 was relatively quiet from a motoring perspective, the changes that did emerge reflect a clear direction of travel: rewarding lower emissions and higher mileage, while gradually tightening the system elsewhere.

Electric Car VRT Relief: Unchanged For Now

One element of motoring tax that technically did not change in Budget 2026 is Vehicle Registration Tax (VRT) relief for electric vehicles.

The existing relief remains in place:

- Up to €5,000 VRT relief is available on new electric cars

- Full relief applies to EVs priced up to €40,000

- Relief tapers for vehicles priced between €40,000 and €50,000

- No relief applies to vehicles priced above €50,000

However, the significance lies not in what changed but in what didn’t. The Government confirmed that this relief is guaranteed only until the end of 2026.

Electric car sales rose by 35% in 2025 compared to 2024, underlining how effective incentives have been. But with fuel tax revenues declining, the Department of Finance has already signalled that the current system may not be sustainable in the long term. A weight-based VRT model has been floated previously, and while nothing is confirmed, Budget 2027 may bring a more fundamental rethink.

Why Electric Cars Now Have Their Own BIK Band

The most consequential change for company car drivers in 2026 is the introduction of a new A1 BIK category, which applies exclusively to zero-emission vehicles.

Previously, electric vehicles and many plug-in hybrids were grouped together at the lower end of the emissions scale. From 1 January 2026, that distinction has been formalised, giving EVs a clear tax advantage over all other drivetrains.

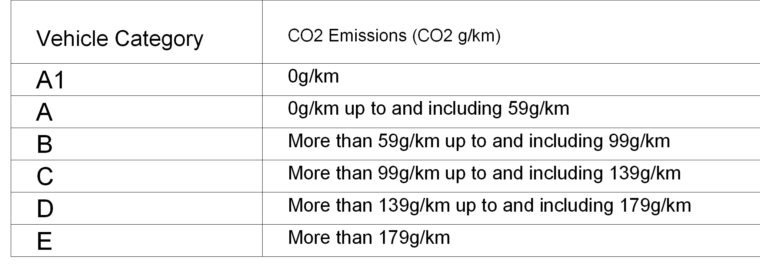

Vehicle Categories and CO₂ Emissions (2026)

This new structure separates fully electric vehicles from plug-in hybrids and low-emission petrol or diesel cars, rather than grouping them together at the lower end of the scale.

Why Mileage Matters For Company Car Tax

As in previous years, BIK continues to be calculated using a combination of CO₂ emissions and annual business kilometres. What has changed in 2026 is the increased emphasis on very high mileage. The mileage bands are:

- Up to 26,000km

- 26,001–39,000km

- 39,001–48,000km

- 48,001km and above

The principle remains simple: the more you drive for work, the lower your BIK rate. However, the lowest rates now apply only once a driver exceeds 48,000 business kilometres per year, a threshold that primarily benefits sales roles and other field-based positions.

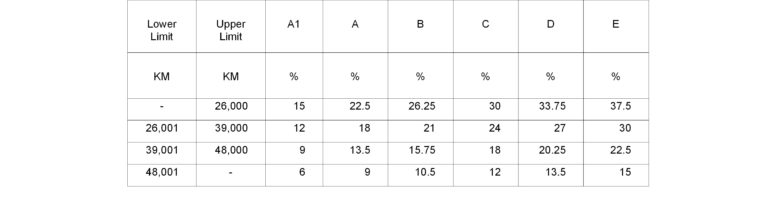

Company Car BIK Rates by Mileage and Emissions (2026)

In practical terms, only drivers covering very high annual business mileage now access the lowest BIK rates, widening the gap between low- and high-mileage company car users.

For vans, the BIK rate remains unchanged at 8%.

Where the Real Savings Are

Much of the real tax saving in 2026 comes not from headline BIK percentages, but from reductions to a vehicle’s Original Market Value (OMV) for tax purposes.

OMV reductions in 2026

- A €10,000 OMV reduction applies to all vehicles in categories A1–D, including vans

- This reduction remains in place until 31 December 2026, before tapering in later years

- Vehicles in category E do not qualify

Additional Relief For Electric Vehicles

Electric vehicles benefit from a further €20,000 OMV reduction in 2026. Combined with the universal €10,000 reduction, EV drivers can see up to €30,000 deducted from OMV when calculating BIK.

For example, an electric company car with an OMV of €50,000 may be treated as having a taxable value of just €20,000. Applied to a BIK rate of 12%, this results in a notional annual BIK charge of €2,400.

While generous, these reliefs are explicitly temporary, with tapering already scheduled beyond 2026.

Electric vs High-Emission Vehicles: A Growing Divide

The contrast between low- and high-emission vehicles is stark. A high-mileage electric car can attract a BIK rate as low as 6%, while a high-emissions car driven less than 26,000km annually may face a 37.5% charge.

This widening gap is likely to accelerate the move away from traditional company car arrangements, particularly for employees whose roles do not involve substantial business travel.

Charging, Home Chargers and Electricity Costs

Several BIK exemptions continue to apply for electric vehicle users:

- No BIK applies where an employer provides EV charging facilities at the workplace, provided they are available to all staff

- No BIK arises where an employer installs a home charger, provided the employer retains ownership

- Employers may reimburse electricity costs for charging an employer-provided EV tax-free, subject to adequate records being retained

What Employers Should Be Watching

Employers are required to apply the correct BIK rate through payroll in real time, based on accurate mileage data. Revenue has repeatedly stressed the importance of proper record-keeping, and company car BIK remains a frequent focus of compliance checks.

With incentives tapering and rules becoming more granular, inaccurate mileage reporting or outdated payroll assumptions now carry greater risk.

The Bottom Line

For 2026, the message from Revenue is clear: lower emissions and higher mileage are rewarded. Electric vehicles remain the most tax-efficient company car option, particularly for high-mileage drivers.

What remains uncertain is how long these incentives will last. With VRT relief and OMV reductions already scheduled to taper, company car drivers and employers alike may find that today’s savings come with a defined expiry date.

As ever with motoring tax, the detail matters and the next Budget may matter even more.

What to Check Before Buying or Leasing a Company Car

Before choosing or switching a company car, it’s worth checking the full background of any vehicle, including ownership history, mileage records and previous use.

Motorcheck provides detailed vehicle history checks for cars registered in Ireland helping drivers and employers make more informed decisions before committing to a purchase or lease.

Frequently Asked Questions: Company Car BIK in 2026

What are the main changes to company car BIK in 2026?

From 1 January 2026, fully electric vehicles move into a new A1 BIK category, separating them from plug-in hybrids. BIK continues to be calculated using CO₂ emissions and business mileage, but the lowest tax rates now apply only to drivers covering more than 48,000 business kilometres per year.

Are electric vehicles still the most tax-efficient company cars?

Yes. Electric vehicles attract the lowest BIK rates and benefit from significant OMV reductions in 2026. However, these incentives are time-limited, with tapering already scheduled in later years.

How is Benefit-in-Kind calculated for a company car?

BIK is calculated as a percentage of the car’s Original Market Value (OMV), adjusted for any applicable reductions. The percentage used depends on the vehicle’s CO₂ emissions band and the number of business kilometres driven annually.

Do higher business kilometres always reduce BIK?

Generally, yes. Higher annual business mileage results in a lower BIK percentage. However, accurate mileage records must be maintained, as Revenue places significant emphasis on compliance and verification.

Do plug-in hybrids still qualify for lower BIK rates?

Plug-in hybrids remain in a lower emissions band (A), but they no longer receive the same treatment as fully electric vehicles, which now sit in the more favourable A1 category.

Are home EV chargers and charging costs still exempt from BIK?

Yes. No BIK applies where an employer provides EV charging at the workplace or installs a home charger, provided the employer retains ownership. Employers may also reimburse electricity costs tax-free, subject to proper records being kept.

When could company car tax rules change again?

Several current reliefs are due to taper after 2026. Further changes may be announced in Budget 2027, particularly as the Government reviews long-term motoring tax revenues.