With January looming fast in the windscreen, the time has come to make decisions on your car buying for 2018. Buy new in January? Buy used? An import?

Chances are, whatever your final decision, you will come across PCP finance, or Personal Contract Plan, during your research. PCP's have become a major driver of new car sales in Ireland in the past few years, and in some cases have even begun to be offered on used cars too.

Why use a PCP?

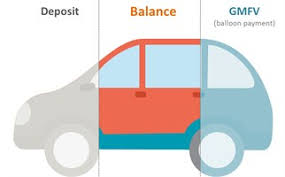

What’s the attraction? Lower monthly repayments. The idea of a PCP is that you take the notional used value of the car after three years, and call that the Guaranteed Minimum Future Value (GMFV), which is underwritten either by the dealer selling you the car, or the car company that makes it. The GMFV is then subtracted from the price of the car, and left to the end of the finance period to deal with. That means that you’re financing a smaller amount of money, and getting lower monthly repayments. At the end of the lease period, you can either trade-in for another new car, hand back the car, which wipes out the remaining GMFV payment, or pay the GMFV in cash, and keep the car.

What’s the attraction? Lower monthly repayments. The idea of a PCP is that you take the notional used value of the car after three years, and call that the Guaranteed Minimum Future Value (GMFV), which is underwritten either by the dealer selling you the car, or the car company that makes it. The GMFV is then subtracted from the price of the car, and left to the end of the finance period to deal with. That means that you’re financing a smaller amount of money, and getting lower monthly repayments. At the end of the lease period, you can either trade-in for another new car, hand back the car, which wipes out the remaining GMFV payment, or pay the GMFV in cash, and keep the car.

PCP's as a retention tool for a dealer

PCPs are advertised as being flexible, low-cost, and convenient and this they most assuredly are. They are also tricky at times to get your head around, and there’s a significant trap-door where used values are concerned.

PCPs are advertised as being flexible, low-cost, and convenient and this they most assuredly are. They are also tricky at times to get your head around, and there’s a significant trap-door where used values are concerned.

Obviously, the primary catch with a PCP is that it incentivises you to come back to the same dealer in three years time and roll the plan over for another new car. It’s a way of using the carrot of those low monthly costs to keep you coming back again and again. Built-in customer loyalty, as it were.

Any potential risks?

Now, clearly there’s the potential for mistakes, and even worse, when it comes to car dealers selling you what is actually quite a complex financial product. According to Paul Linders, a long-time Dublin-based car dealer, staff and dealer principles are at least aiming at the highest possible standards in this case. “We have to be very careful in selling a PCP, and we do tend to approach it as the first option when dealing with a customer” Mr Linders told Motorcheck. “There’s no pressure coming from the manufacturer, but I would say that there’s encouragement and of course there’s a partially vested interest on my part and the manufacturers’ part – obviously we would both like to have a customer coming back in three years’ time. Clearly, the success of my firm depends on me selling new cars, but equally I don’t want to stitch someone up with a deal that’s not right for them. We always try to make the point that we don’t want to sell you this car, we want to sell you every car.”

Now, clearly there’s the potential for mistakes, and even worse, when it comes to car dealers selling you what is actually quite a complex financial product. According to Paul Linders, a long-time Dublin-based car dealer, staff and dealer principles are at least aiming at the highest possible standards in this case. “We have to be very careful in selling a PCP, and we do tend to approach it as the first option when dealing with a customer” Mr Linders told Motorcheck. “There’s no pressure coming from the manufacturer, but I would say that there’s encouragement and of course there’s a partially vested interest on my part and the manufacturers’ part – obviously we would both like to have a customer coming back in three years’ time. Clearly, the success of my firm depends on me selling new cars, but equally I don’t want to stitch someone up with a deal that’s not right for them. We always try to make the point that we don’t want to sell you this car, we want to sell you every car.”

What about that second hand value trap door, though? You see, the GMFV is basically a best guess from the dealer and the finance company as to what the car will be worth in three years’ time. They then subtract a further bit of safety margin from that notional figure, both to allow for market fluctuations and to leave some equity in the car, which can then be used as a deposit for the next one.

Upside of PCP's

The upside to this is that you’re essentially insulated from depreciation for this car. You know the minimum that it will be worth, the dealer will contractually stand over it, and if the market collapsed entirely, you could still just hand back the car and walk away scot free.

The upside to this is that you’re essentially insulated from depreciation for this car. You know the minimum that it will be worth, the dealer will contractually stand over it, and if the market collapsed entirely, you could still just hand back the car and walk away scot free.

If that market collapse did occur, though, you’d be left with no equity in the car, and therefore no deposit to roll the deal over for a new one. Is there seriously a danger of that happening?

Is the future risk a concern?

Well, it already is. The flood of imported cars from the UK has seriously holed Irish second hand values below the waterline. Dealers are frantically discounting their second hand stock to try and keep buyers on these shores, and that’s having a major effect on values. And that’s only going to get worse. Diesel sales in particular have collapsed in the UK, and the value of diesel-engined cars in the British market has plummeted. With imports showing no signs of slowing down, and their prices heading for the floor, that can only mean one thing. Lower prices for second hand cars in Ireland. Graham Hill, a UK-based car finance expert, told Motorcheck that “the recent announcement of a first year VED motor tax rate hike on new diesel cars from April next year is designed to sidestep headline-grabbing increases on other motor vehicles like vans, but it still adds to the negative narrative that is talking the automotive market down. In the run-up to the Budget, new and used car sales of diesels have suffered significantly, which has had a wider effect on the new car market as customers hold off on purchases in the hope that values recover.”

Well, it already is. The flood of imported cars from the UK has seriously holed Irish second hand values below the waterline. Dealers are frantically discounting their second hand stock to try and keep buyers on these shores, and that’s having a major effect on values. And that’s only going to get worse. Diesel sales in particular have collapsed in the UK, and the value of diesel-engined cars in the British market has plummeted. With imports showing no signs of slowing down, and their prices heading for the floor, that can only mean one thing. Lower prices for second hand cars in Ireland. Graham Hill, a UK-based car finance expert, told Motorcheck that “the recent announcement of a first year VED motor tax rate hike on new diesel cars from April next year is designed to sidestep headline-grabbing increases on other motor vehicles like vans, but it still adds to the negative narrative that is talking the automotive market down. In the run-up to the Budget, new and used car sales of diesels have suffered significantly, which has had a wider effect on the new car market as customers hold off on purchases in the hope that values recover.”

So, what to do? Buy carefully is the short answer. Aim for cars that are as depreciation-proof as possible, and be at least alert, if not outright wary, of finance packages that rely on the second hand value of a car. With the market fluctuating as much as it is, it could well be that for 2018, some old-school methods might be the superior ones.